Welcome to a broad introduction to investment. This topic can quickly become as complex as you want it to be, and that’s where our team of financial advisors in Melbourne can assist.

So, when your head is around the essentials, contact us for the best wealth-creation advice. We can provide a no-cost, no-obligation catch-up to discuss your investment goals and strategy.

People invest in shares because, put simply, the share market provides a solid return on investment. Over the last 25 years, the Australian stock exchange has risen by figure. Generally, Australian shares will deliver higher returns than fixed-interest funds or property investments.

In most cases, shares can be quickly and easily accessed (unlike property and many fixed interest funds) in the case of an unexpected need or emergency. You can sell literally with the click of a button and expect cash in your bank account within a working week.

Wealth creation aside, another big reason investors participate in the share market is the thrill – that rush of adrenaline in seeing assets climb in value or making swift decisions to buy and sell.

There is no question this can be a dynamic, exciting and incredibly rewarding form of investment. The earlier you start, the more time you have to achieve your objectives. It stands to reason that if you invest $2000 at age 25, by the time you retire, you should expect to see remarkably different (and better) results than if you invested the same amount at age 45. Obviously, many factors and variants (such as risk tolerance, market value at the time of investment, asset class selection, etc.) come into play.

The best time to invest in shares is now! If you are a young adult, provided you go about things strategically, you stand to enjoy the most benefits from investing your money.

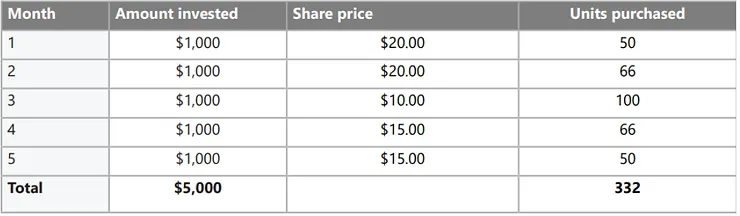

As seen in the table below, this concept involves investing the same amount of money at regular frequencies, irrespective of market highs or lows.

We can see from this table that the average share cost levelled out at $15.06 (the overall investment figure of $5,000 divided by 332, being the total number of shares purchased). The total investment value after five months was $6640, delivering a $1,640 profit. If this investor had purchased all 332 shares at the start of their journey, they would not have seen a return by month five.

This strategy avoids closely monitoring the market to choose your time well and encourages investment discipline. If markets fall, only a portion of the overall amount is exposed. During this drop, your regular purchase will acquire more shares or units. If the market is in constant decline over the investment period, then the portfolio will, of course, lose value. However, it will lose less than an upfront portfolio purchase during the same period.

When market prices are trending upwards, a portfolio purchased upfront will do better than the portfolio purchased using dollar cost averaging. This is because the full gain on the price rise is captured by the total amount of money invested upfront.

It refers to spreading your portfolio over various asset regions, classes and markets, thus dispersing risk. This approach can smoothen your journey as asset class returns fluctuate. There are different categories of asset allocation, each offering pros and cons.

This refers to applying a long-term approach to a portfolio, reflecting goals further ahead in the future and willingness for risk. The strategy involves the investor allocating targets (influenced by risk, duration and goals) to asset classes and rebalancing the portfolio at certain periods in time.

This adopts a short-term strategic view of the portfolio and involves shifting the percentage balance of assets to take advantage of market fluctuation. For example, an investor is concerned about a possible recession negatively impacting their share returns. As such, they shift their balance to, for example, 25% stocks, 65% bonds and 10% cash.

This is the Goldilocks approach; it sits in between SAA and TAA and takes a medium-term view. DAA offers a level of agility to change the portfolio’s asset mix, take advantage of ad-hoc opportunities and help maintain wealth in the event of a market drop.

All three strategies can invest in both defensive and growth asset classes.

Fixed interest investments and cash are defensive asset classes. These typically offer a lower return across a long-term approach. However, the positive is that they are usually less volatile and run less risk of dropping in value.

Australian and foreign shares, property securities, hedge funds, and infrastructure are examples of growth asset classes. These are typically more volatile than defensive asset classes. However, they can potentially deliver greater returns over a longer period.

Depending on the specific type of asset, there are pros and cons. For the purposes of this broad overview, we won’t go into detail here. However, we recommend reading about investment concepts in our ActOn Wealth Knowledge Centre or speaking to a wealth management advisor on our team.

We cannot answer this until we know you and your financial situation. ActOn Wealth relies on an objective way to measure your risk tolerance, and this is a foundational part of your wealth-building journey with us. Contact our team to find out how we go about doing this.

This is probably better referred to as lack of diversification risk! In a nutshell, it’s when you put all your eggs into one basket. In the event this asset drops in value, so does 100% of your portfolio. Diversifying investments better levels out the risk.

We recommend you visit our Knowledge Centre for a more detailed summary of investment risks or organise to catch up with one of our wealth and security planners.

This is the possibility that your investment return doesn’t match inflation, and therefore your true wealth value declines. A diverse portfolio should minimise the likelihood of this risk.

The Australian dollar rises and falls against foreign currencies. This exchange rate fluctuation can negatively – or positively – affect your foreign share portfolio. Again, the answer lies in diversification (so investing in shares across multiple international currencies).

Liquidity risk refers to your inability to access funds when required. For example, in the event of an emergency. Distributing investments across a range of asset classes helps overcome this potential challenge.

In this instance, diversification might not provide an adequate safety net, as it refers to the market overall experiencing a devaluation. We work to mitigate this risk by considering the investment time frames for each asset class.

Government legislature changes can negatively – and positively – affect share market value. Here at ActOn Wealth, we prefer to make decisions based on the legislature as it exists right now. However, we keep our finger on the pulse to remain aware of future changes.

We understand this area of finance can be a lot to wrap your head around, and that’s why we’re here to help! Some reasons our clients trust us with personal investment advice include:

Ok – that was a lot of information! We’re glad you made it to the end, and we hope you’ve now got an appetite to learn more. The ActOn team is here to provide tailored investment solutions and empower you with the financial knowledge and tools you need before investing. Let’s meet and see how our wealth investment advisor can help you.

Please note this article is not investment advice. Contact our financial planners in Melbourne for the best advice for your situation and goals.